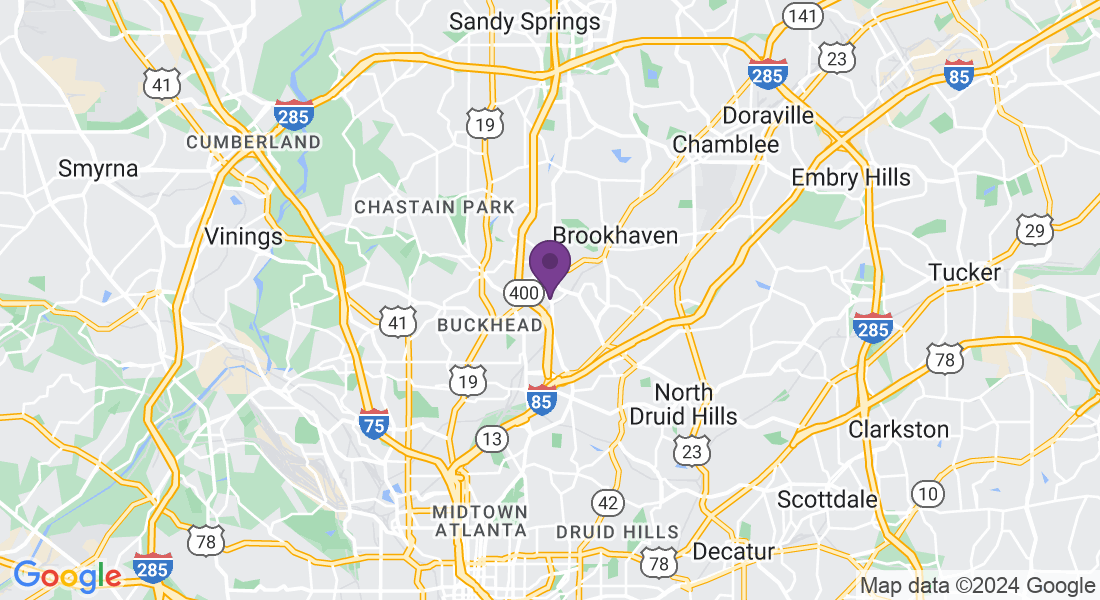

WELCOME TO THE ATLANTA

HOMEBUYER'S COURSE

Here's What You Need to Know About

Buying a Home In Atlanta ...

Homebuyer's Course

WELCOME

You Need an Expert

Buyer's Compensation

Choosing the Right Lender

Making an Offer and Negotiations

Your Offer Is Accepted

Inspections Are Complete

The Final Steps

Erin Brockovich Buyer Compensation

Nestled in the vibrant heart of North Georgia, Atlanta offers an unparalleled blend of serene suburan living and the convenience of city life.

Whether you're a first-time buyer or looking to upgrade your living situation, our tailored market updates, captivating community videos, and comprehensive real estate insights make your home buying journey seamless and enjoyable.

Exclusive Market Updates

Stay ahead of the curve with our up-to-minute market updates. from the latest listings to price trends we ensure you have all the information you need to make informed decisions. Atlanta's real estate landscape is dynamic, and with our expert analysis, you're alway in the know.

Market Updates

National Market Update

NAR Market Update

Market Trends

Buyers Tips

Considering Buying?

Buying a home can be an exciting but also challenging experience. If you're planning to buy an Atlanta home, it's important to be prepared and aware of what to expect throughout the process. This short guide is designed to provide buyers like you with valuable insights and tips to navigate the purchase of your Atlanta property successfully.

DOWNLOAD TO ACCESS:

The Ultimate Guide

A Step by Step Process to Buying A Home

Join Nehemiah Davis TO:

Learn How To Generate TRUE Passive Income

By Creating A Digital Product In Your Chosen Niche Using Your Existing Knowledge And Expertise!

Date: March 8th | Time: 7:00PM EST

Join from wherever you are (virtual event)

What’s On Offer Inside My FREE Masterclass?

Learn How To Leverage Your Knowledge & Expertise To Make Passive Income

Discover How To Quickly Create Your First Digital Product(s)

Unlock The Secrets To Selling Your First Digital Product For Massive Profits

Learn How To Scale Your Digital Product(s) To Six Figures & Beyond

Preparing for a possible move this summer? Click below to check out our moving checklist to your whole house ready for the next home!

Want to know what is happening throughout Atlanta now?

Click below for a full live schedule of local events around town!

ATLANTA STATS & LOCAL INFO

WELCOME TO THE VIRTUAL HOME BUYER SEMINAR ATLANTA

If you're either thinking about purchasing a new home or already made the decision to purchase a house, but you still have questions or concerns regarding the process, price or anything else - let me tell you:

You're in the right place.

This free home buyer seminar is giving you the exact step by step blueprint on everything you need so you can get clarity on everything A-Z and guide to you make the best decision in purchasing your new home.

You will learn about timelines and timing, inspections, loan pre-approvals, negotiations, and so much more.

Take a look around and let us know how we can help you.

Mellanda Reese | Broker & Owner

Andora Realty Group

License # 334081

WELCOME TO THE VIRTUAL HOME BUYER SEMINAR LIBRARY

Enjoy the latest & most up-to-date marketing & sales tactics to help you purchase a NEW home.

Thinking About Buying?

Are you thinking about buying a home but you don't know where to start?

Learn to take advantage of Tax Saving opportunities instead of throwing your money away

Walk through the important aspects of purchasing a home

What to Expect When Buying a Home

Purchasing a home is most likely going to be one of the largest investments you will make in your lifetime.

We have helped hundreds of clients in the past and we can help you too

My team and I are free! The seller pays for our fees and they have an agent who has their best interest at heart. We are here to have yours

Home Buying Process -

First Step

The first step when looking to buy a home is getting qualified for a loan.

Before doing anything else you need to know what you can afford by getting qualified for a loan

Don’t go house hunting before going mortgage shopping

Pre-Approval vs

Pre-Qualification

Why you need an approval rather than just a pre-qualification.

Pre-Qualification is not a true approval but the initial step in a home loan process where you discuss your financial situation with a loan officer - nothing is verified

Pre- Approval is where the buyer provides the lender with the necessary documents to tell them what they are approved for, which loan option is the best for them and what the interest rate will be

10 Must Not’s When Buying a Home

Once you find your dream home, we need to make sure you get to move into it.

Don’t change jobs; becoming self employed or quit current job

Don’t buy a vehicles

Don’t use any charged cards or let your accounts fall behind

Don’t spend money you saved for closing

Don’t omit any debt or liabilities from your loan application

What are the Pros and Cons of Purchasing a Home?

Whether you’ve never owned a home before or it’s been a while since you’ve purchased, let's talk about the pros and cons.

Pro: Your wealth can increase as you build equity in your home through 2023 averaging about 3%

Con: Maintenance costs; work and money to keep a home in good condition

How Much Money Do I Need To Purchase a New Home?

Most people are afraid that it will cost them thousands and thousands of dollars to purchase a home in Atlanta.

There are various loans and grants to qualify to purchase a home

3 Tips To Get Your Offer Accepted

Are you competing with other buyers on your dream home or do you want to make sure you’ve got the best chance of getting your offer accepted?

Make sure you offered a competitive price on a home

Put down a larger earnest money deposit

Let the seller know that you have not written offers on any other properties

How To Choose An Agent

To Work With

Choosing an Agent to represent you is one of the most important decision you will make

An agent is more than just a door opener

Your agent should be proactive and make your process seamless and stress free

COMMUNITY VIDEOS

Let's Get You Prepared To Buy A Home

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. Message frequency varies. Message & data rates may apply. Text HELP to (404) 217-6005 for assistance. You can reply STOP to unsubscribe at any time.

Meet Mellanda Reese

Mellanda Reese | Broker & Owner

Broker & Owner

License # 334081

Meet Mellanda Reese

With over two decades in real estate, Mellanda Reese stands out not just for her expertise but for her passion for guiding clients through significant life transitions. As the heart of Andora Realty Group, she combines deep industry knowledge with a personal touch, making every real estate journey seamless and successful.

Mellanda’s approach is rooted in understanding and empathy, recognizing that every sale or purchase is more than a transaction—it’s a pivotal moment in your life. Her global perspective, enriched by her love of travel, brings creativity and a broadened view to local real estate, ensuring your needs are met with exceptional care and insight.

Whether stepping into the market for the first time or finding your dream home, Mellanda and the Andora team are your trusted partners, committed to turning your real estate goals into reality.

SUPPORT OUR SMALL BUSINESSES

Visit our blog for more real estate tips, home tips, and local information

Unlocking the Golden Ticket of Homeownership: How Equity Can Transform Your Next Move in Atlanta

“Home equity is more than just a financial tool - it's a gateway to achieving your dreams and securing your future.” - Mellanda Reese

Understanding Home Equity for Homeowners in Atlanta, GA

For many homeowners in Atlanta, GA, home equity can feel like a golden ticket. This powerful financial tool represents the portion of your property that you truly own and can be leveraged for a variety of important purposes. Whether you're looking to renovate your home, consolidate debt, or finance a major purchase, understanding home equity is key. Let’s explore what home equity is, its benefits, and how you can make the most of it.

What is Home Equity?

Home equity is simply the difference between your home's current market value and the amount you still owe on your mortgage. For instance, if your home is worth $300,000 and you owe $200,000 on your mortgage, your equity amounts to $100,000. This equity increases as you pay down your mortgage and as your home’s value appreciates.

How Home Equity Builds Over Time

Home equity grows through two main factors: paying down your mortgage and home appreciation. With each mortgage payment, you reduce the principal balance of your loan, thereby increasing your equity. Additionally, as home values in Atlanta rise, so does the market value of your property, further boosting your equity.

Benefits of Building Home Equity

Building home equity has numerous financial benefits. You can tap into this equity through loans or lines of credit for home improvements, paying off high-interest debt, funding education, or even investing in additional properties. Moreover, having significant equity can act as a financial cushion in times of need.

Leveraging Home Equity: Options for Atlanta Homeowners

If you're a homeowner in Atlanta, GA, you have several options to tap into your home equity. Understanding these options can help you make smart financial decisions that align with your goals.

Home Equity Loans

A home equity loan allows you to borrow a lump sum of money against your home’s equity. This type of loan typically comes with a fixed interest rate and repayment term, making it a good option for significant expenses like home renovations or debt consolidation.

Home Equity Lines of Credit (HELOC)

A HELOC works like a credit card but uses your home as collateral. You can draw from this revolving line of credit as needed, up to a predetermined limit. HELOCs usually have variable interest rates, making them suitable for ongoing or unpredictable expenses.

Cash-Out Refinancing

Cash-out refinancing involves refinancing your existing mortgage for a higher amount than you currently owe, with the difference given to you in cash. This option is beneficial if you want to take advantage of lower interest rates while accessing your home equity.

Maximizing Home Equity in Atlanta, GA

To maximize your home equity, consider these strategies specifically tailored for Atlanta homeowners.

Regular Mortgage Payments

Making consistent mortgage payments is the simplest way to build home equity. As you pay down your loan balance, your equity grows.

Home Improvements

Investing in home improvements can increase your property’s value. Strategic upgrades, such as modernizing the kitchen or adding energy-efficient windows, can significantly enhance your home’s market value and, in turn, your equity.

Market Trends

Keep an eye on the real estate market trends in Atlanta. Understanding when property values are likely to rise can help you make timely decisions to maximize your equity.

The Golden Ticket of Homeownership

Home equity is often considered the "golden ticket" of homeownership, especially for those who have been in their homes for several years. As I explain to my clients at Andora Realty Group, your equity can be your golden ticket to your next move. It’s the value you’ve built up in your home over the years, both from paying down your mortgage and from your home’s appreciation.

Building Significant Equity

Many homeowners in the United States have built up significant equity, either by fully paying off their mortgage or by paying down enough combined with home appreciation to have at least 50% equity. According to CoreLogic, the average homeowner with a mortgage has around $298,000 built up in equity.

Utilizing Your Equity

So, what can you do with this much equity? For starters, if you’re planning a move, selling your home can provide a larger down payment on your next one, which means borrowing less from the bank. In some instances, you may have enough equity to pay all cash on your next purchase, which can be incredibly advantageous.

Enhancing Affordability

Having equity in your home can make your move possible when affordability is tight. Additionally, the more equity you have, the more options you have to buy down your interest rate and secure a more affordable payment.

FAQ

How does home equity impact my net worth?

Home equity is a significant component of your net worth. It represents the value of your ownership stake in your property and can be a substantial asset.

What are the risks of tapping into home equity?

The primary risk of using home equity is that your home serves as collateral. If you're unable to make payments on a home equity loan or HELOC, you could risk foreclosure.

Can I use home equity to buy another property in Atlanta?

Yes, you can use home equity to finance the purchase of another property. This strategy can be particularly effective if you're looking to invest in rental properties or vacation homes.

How do I determine the current value of my home?

You can determine your home's current value through a professional appraisal, online real estate platforms, or by consulting with a local real estate agent.

Are there tax benefits to using home equity?

Interest paid on home equity loans or HELOCs may be tax-deductible if the funds are used for home improvements. Consult a tax professional to understand the specific benefits in your situation.

Understanding and managing home equity effectively can unlock significant financial potential for homeowners in Atlanta, GA. Whether you’re looking to renovate, invest, or simply build your wealth, leveraging home equity can be a smart strategy. For more personalized advice and to understand your home's current market value, reach out to me, Mellanda Reese at Andora Realty Group.

WHAT PEOPLE ARE SAYING ABOUT ANDORA REALTY GROUP

"The Andora Group Is The Absolute Best Way To Go For A Smooth Home Sale!"

"Working with Mellanda has been a pleasure. She is professional, caring, and knowledgeable. She really cared about making sure we were taken care of through the entire process and we still have dinner with her once a month. She has become a part of our family."

-Norm & Jane Y

"I Could Go On For

Pages Expressing Our Gratitude!"

"Working with Mellanda was a true blessing. Because of Mellanda’s experience, knowledge, wisdom, patience, negotiating power and compassion, we were effectively transitioned out of our home! This happened in a relatively short period of time. I could go on for pages expressing our gratitude and testimony. I trust Mellanda to sell and buy a home for my family anytime."

-Andrea C.

"Thanks To Her

Expertise We Received Multiple Full Price Offers!!"

"Mellanda Reese is an outstanding realtor!

She is completely committed to delivering stellar customer service. She responds promptly to and truly acts in the best interests of her clients. We highly recommend Mellanda to anyone looking for an agent whose knowledge and negotiating skills are second to none."

- Nita C.

Want to be sure you dont miss out on any local tips & local real estate market updates?

Have them delivered to your inbox.

Subscribe to the monthly digital newsletter below!

Got questions? (404) 217-6005 OR

E-mail: [email protected]

© 2024 ANDORA GROUP | All Rights Reserved

Terms Of Service | Privacy Policy | Disclaimer | Contact | Refund Policy

Copyright 2021 - for Circle of Greatness LLC - All Rights Reserved.

Nehemiah Davis and the Circle of Greatness, LLC are not a part of Facebook.com or Facebook Inc. Additionally, Nehemiah Davis and the Circle of Greatness, LLC are not endorsed by Facebook, Inc. in any way. Facebook is a trademark of Facebook, Inc.

Disclaimer: Sales results listed above or in my marketing material are not typical and are the result of hard work, training, experimenting and learning from mistakes. These figures and results are used specifically as examples. Your results will vary depending on a wide variety of variables and factors.